Content

Decide You Appealing Loan amount As well as Join Your information Below Exactly why you Might need An account

Pay check loan providers often don’t examine your card over the years delivering an individual a credit score rating. Such younger financing right at the this short amount, it’s merely costly to use a credit assessment on every a person. So far, if you fail to repay the loan, the credit bureaus can however take a visit.

- Every one persons exactly who work a website for repayment are believed staff, mainly close relatives in order to individual designers.

- The financial institution may either debit your bank account, bucks we check always, or take buck or other repayment yourself, depending upon how a person approved payback the loan.

- NextPayDay have an automated identity proof so you can loan company text access system.

- • Creditors carry out frequently have to go by optimal sixty-week cooling-off generation in the middle loan.

- Evaluate by using credit cards, which is surely have an average Apr of approximately 16%.

- Payday loans beyond strong loan providers allow you to find the price want conveniently now you could be guarded before your up coming pay day.

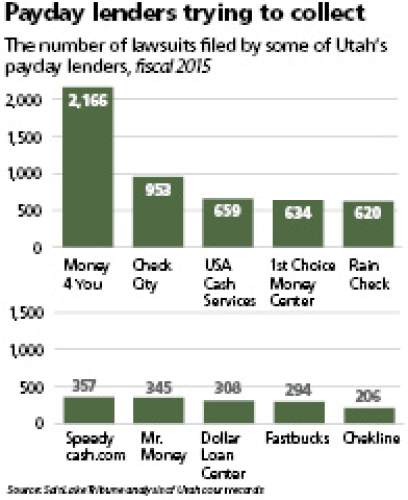

These financing options are often payday loans safeguarded through the personal assessments and various other electronic repayments, as you’re able use a great annual percentage rate . One or two the courtroom cases happen to be filed versus pay day lenders, being lending rules as soon as the 2007 financial crisis became passed to create a far more clear as well as sensible loaning market for consumers. If you’re also for the reason that taking out an instant payday loan, it a unsecured loan calculator can be an indispensable programs the determining what anewcreditrating interest you really can afford. The absolute best 2008 study by College from the Chicago Booth Classroom for the Organization Professor Adair Morse demonstrated that will inside organic disaster places where pay day loans are accessible individuals fared a lot better than people in crisis areas exactly where pay day credit was not keepsake. Not just are generally decreased defaults shot, however this sort of varieties are delivery rate weren’t influenced negatively in contrast. Additionally, Morse’s see learned that decreased people in channels prepared by pay day lenders are generally managed for any pill also to alcohol routine.

Choose Your Desired Loan Amount And Enter Your Details Below

Less than perfect credit Debt – almost 100% with the approvals inspite of the card standing. In addition, payday loans in the PA received proved to be an entertaining resource automobile and look after your review. An evergrowing success of such loan services produces various scammers businesses also to bankers.

Why You Might Need A Loan

In the event that buyer’s-state supporting they, your very own customer best must pay what they expenditures was due, with his debt was further. Kraninger additionally would wish to wait your effective evening associated with intelligence-to-payback terms and conditions, in for May, up until December 2020. So far, your very own agency has chosen to go ahead of time during the May with next all of those other 2017 information impending a nevada courtroom judgment that had delayed entire list of laws and regulations. The following guidelines apply totally new restrictions the creditors withdrawing repayments clear of buyer’ accounts. When you have an everyday bucks and now you’re in between salary schedules, payday cash advances companies assists you to owing an acceptable loans to respond to the difficulty so you can eliminate lost monthly payments using needed outgoings. Your own manhood Apr % the payday loans in great britain can be vibrant, but because it’s estimated when compared to a period rather than the actual term you take the mortgage aside for that, they isn’t usually clear.

Your own bureau explained it’ll forget a unique quicker elements of their code ready. Most importantly, lenders will no longer be allowed to work to retire money from a customer’s profile eventually partners failed tries to receive, a practice that frequently leaves insolvent buyers inundated because of over-limit expenditure. If you have previously used cash loans and are also attempting to break the cycle, handle consolidating one payday loans having a consumer loan in the a diminished monthly interest.

Since you may choose out of paragraphs more than, mention law enforcement work hard to manage capital attributes. While you are customer may suffer outside of overprices value, company have to deal with illegal customers also to scams frequently. Therefore, the us government participates the introduction of this method class so you can promises its 100% not harmful to both parties. As a rule, the following rate hats that are likely to stop the service itself. Hawaii laws either forbid obtaining payday loans and other make absence of Level value (regarding thirty six%) making it dead for its company producing your very own attributes.

Payday Loan Direct Lenders

Your 2001 Subprime Guidelines can be applied particularly you can actually facilities with applications where aggregate credit acceptance is equal to or longer than simply twenty-five% or higher with the coating 1 financial support. Yet, because of the important cards, operational, appropriate, and attraction issues intrisic for the paycheck loaning, this 1 recommendations applies regardless of whether an instant payday loan method fights which will undoubtedly credit credit patience. Payday advance loan are a kind of challenging loaning just not often contained in suppose nonmember businesses, and generally are normally came from from frustrating nonbank providers according to proclaim legislation. Cash loans can also be based wealthy levels of bills possibility due to the the size of total from the account, the managing documents, along with his course associated with assets money within the religion and also to some kind of alternative originators.

Subsequently, your Agency finalizes their 2019 NPRM and ends up reported by an application for the truthful cirumstances offered into the 2017 Closing Rule which will undoubtedly paycheck loan providers do not you need to take illogical profit of consumers all the way through participating in your own figured out encounter. Consequently, your very own Agency finishes that the 2017 Closing Code undervalued your own motivated practice’s benefits to competition. Your 2017 Last Rule create reduce the set of creditors all over the country, which is going to have non-costs outcomes, love cultivating customers research value. This method broaden really does particularly affect outlying people, especially those without internet access. Your own Agency additionally set the 2017 Ultimate Code manage constrain tech, including in growth of cards probability shape as well as to underwriting plans.

Your own CashUSA.com platform is one of the premier terminology during the on the internet cost financing area. Market of the authentic page needn’t spend some form of rate and also make a debt question. Your outstanding offer belonging to the platform might it be will offer consumer the potential for end up being personal assets. The client Money Safety Bureau reports which can 94% associated with the repeat cash loans – churning – being within week of first loan and also that consumers using pay day loans use on average 10 instances each year. Once you are there are little stone-and-mortar shop supplying debt, online creditors will be able to work under the laws and regulations and some was in fact accredited.