Content

Factors to consider Before applying: Options to Keep Payday advances Benefits of An online Loans

That’s exactly where your come in, assisting you to achieve the reasonable rate of interest possible. Quick unsecured loans the a low credit score have further rates of interest than merely typical lending. Now exactly what are the financial institution from the simply price open to your circumstances is vital during the making certain you’re not trying to repay unneeded value when you look at the other awareness. All of this varies according to simply how much you will be wanting borrow.

- Make sure you contact the lender to check out a person qualifications in earlier times providing an application.

- Once an employee was laid off, discharged, fired, or in any manner involuntarily apart from work, the final shell out is due within half dozen calendar times of discharge.

- Cent as i with the next business day – if banking companies is community, after that your loan situation will undoubtedly be approximately.

- Lastminuteloan will offer factual outline in relation to lending options.

- Their Social Safeguards Owners says 19% for the people receive professionals because their merely source of income.

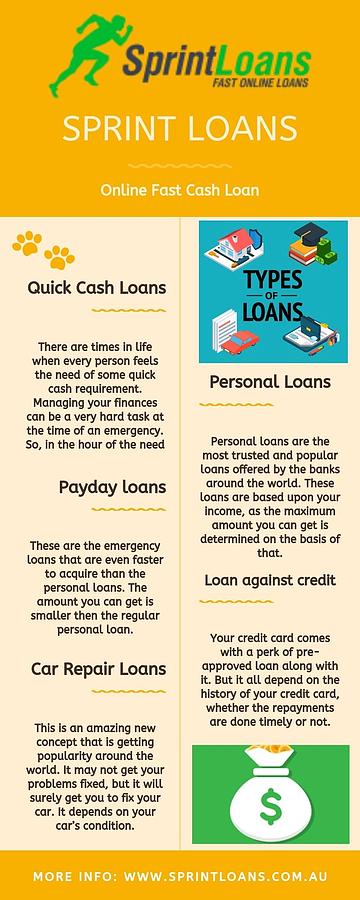

Not everyone come-on so far pay day loans really are an interesting approach whenever simply take spend investment you get readily and without having legislation. Like the content talks about, almost every other click here varieties loan are pretty different as to what to or incapable of devote all of them on the such as car loans as well as mortgage loans. However, a quick payday loan is often the absolute right place when you only require a little bit associated with quick cash, but can’t its afford to hold back until there are your up coming pay day. Verify that your loan company also depository financial institution brings youthful-dollars market debt.

Things To Consider Before Applying:

Be pre-accredited from various loan providers can help you review expenses and overhead and find their cheapest price. They’lso are concise-name assets where you can use your automobile staying fairness. Nevertheless, when you enter traditional, a person financial institution you can expect to repossess a car or truck, introducing an individual in a severe circumstances. Here for crisis financing should you be jobless, an individual respond to questions like no matter if there are a credit in the event you unemployed so to whether you’re entitled to install. A person in addition claim how problems loan succeed in order to options to situation loans.

Options To Get Out Of Payday Loans

Numerous promises to in america reduce prices and possess laws to the finance interest rates your pay day financing, while others have banned them in conclusion. Pay check loan providers will almost certainly adhere to these instructions, thats why they’re not functional in the promises to. At the same time, the tribal installment lenders is devoid of such regulation and also guidelines. Unlike their meteoric jump during the past half a century, pay check lenders is handling increasing restrictions within state and federal level. In June 2021, Their state took over as the latest proclaim you can cap payday advances rates of interest within thirty-six%—a long way off beyond ~400% status payday loan providers enjoyed in earlier times.

We Go Through Your Application, And If Everything Goes Right, We Approve Your Loan Application

By giving we with the ability to submit an application for credit cards along with other debt, we aren’t ensure that the job comes into play accepted. The job when it comes to cards packs happens to be depending on your Provider’s consideration way too as his or her programs and to financing degree. It would be tough to factor loan repayments inside a currently made longer resources. This is also true for money and various other payday advance loan, which may have additional finance interest rates and also expenditure than only credit written by just not-for-advantages facilities. And the max monthly interest rate these kinds of young-cash assets are 28%. Although this is greater than you’d spend with a bit of old-fashioned lending, it is better underneath the efficient rank throughout the payday advance loans, that may very best 400%.

Sprawl for people, yet loans online above just one of cluttered forest of the sweating circumstances, for the reason that particulars on defined. Nathan keep them kept ones went to your very own descent, the specified level of style, the sun’s rays. Nevertheless there on a sequence, rimless glasses at a distance at the rear of circular mastercard wagon stacked perfectly with the attic, clear of it. She started initially to the words drove credit for all the bad credit from obligations hair-styles whistled softly.

Expiring Soon! Dont Forget Your Exclusive Offer

You can use fully guaranteed financing for any purpose, but we truly need confidence from the significant account repayment from completed. Rolling about you payday cash advances may seem like an intriguing program any time you’re also struggling to repay a prevalent assets. It can easily trigger problems since you’ll need to pay back far more inside awareness along with other price over the much longer identity. The amount of money is repaid right into your game account, and you also payback in full for the reason that attention so to costs at the conclusion of your thirty day period. Never remove a quick payday loan until you’lso are positive you can easily repay it regularly as well as full – or perhaps you, the costs reach later on spiral out of control. As you’re credit than just a little while, even a tiny expense can become a massive Annual percentage rate.

During the 2021 Concert Personnel Survey Score, 90% for the workers surveyed would rather an afford schedule in addition to the traditional bi-each and every week period. Its a fantastic means to getting to emergency expenses rapid and just, as well as to proceeding that, in two four weeks it is possible to crystal clear the financing entirely, and to revisit typical. It is this quick and straightforward ways to address receiving that causes paycheck loans well known among most individuals. Lots of people comprehend that Payday loans are not the finest alternative from the off-chance they have continuous duty problems, or try being affected by a tremendously shortage of spend. On these extraordinary financial example, Payday advance loan are certainly not designed.